In recent days, the BRICS platform meeting in Kazan, which brings together Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia and the United Arab Emirates, has been one of the most prominent topics on the information agenda of the Eurasian region. In addition, the meeting has traditionally invited the Secretaries General of international organisations such as the UN, the SCO (Shanghai Cooperation Organisation), the CIS (Organisation of Independent States) and the EAEU (Eurasian Economic Union).

Central Asia was also involved in the BRICS meeting in Kazan, Russia, from 22-24 October 2024, primarily because two Central Asian countries, Kazakhstan and Uzbekistan, were granted BRICS partner status during the meeting. In addition, the BRICS officially accepted 13 countries as partners at the summit in Kazan. In addition to Uzbekistan and Kazakhstan, the new partner countries were Algeria, Belarus, Bolivia, Cuba, Indonesia, Malaysia, Nigeria, Thailand, Türkiye, Uganda and Vietnam. The status of two of Central Asia's leading economic powers as BRICS partners was primarily assessed by media platforms in domestic Central Asian countries in the context of BRICS' global growth. However, given the two leading Central Asian powers Kazakhstan and Uzbekistan, which both have good economic relations with China and Russia - as well as with India, which is expanding - the rapprochement of the two countries towards BRICS was not entirely unexpected at the regional level.

Uzbekistan interacting with BRICS countries

Although Uzbekistan is showing increasing interest in interactions with the BRICS group, as these could open up cooperation opportunities for the country in areas such as expanding and diversifying Uzbek exports and attracting foreign investment. At the same time, it should be noted that Tashkent has a long history of cooperation with BRICS members (notably China and Russia) through other bilateral cooperation.

Nevertheless, in recent years, Uzbekistan's external economic relations with the Platform members have gradually expanded. As a result, BRICS member states are now among Uzbekistan's top 20 trading partners. In 2023, the trade turnover between Uzbekistan and BRICS members increased by 27% and exceeded $25 billion.

However, behind these figures is mainly the deepening of the partnership and strategic relations between, for example, China and Uzbekistan, which in 2024 will have upgraded their relations to an "all-weather" strategic partnership. Thanks to this, favourable macro-economic conditions and mutual trade interests have ensured a rapid growth of economic and investment opportunities (e.g. the construction of a BYD factory in Uzbekistan) between the two countries. At the end of last year, bilateral trade turnover amounted to $13.7 billion. China's share of Uzbekistan's total foreign trade turnover reached 21.9%.

At the same time, Uzbek-Russian relations have reached the level of a strategic partnership, reflected in the growing number of trade-economic and scientific-technical exchanges, as well as the importance of the Russian market for Uzbek agricultural, textile and industrial products, while Russian companies have become important suppliers of equipment and energy equipment to Uzbekistan. As a result, in 2023 the mutual trade turnover between Russia and Uzbekistan approached $10 billion. At present, Russia ranks first in terms of the number of enterprises with foreign capital in Uzbekistan, accounting for more than 3 thousand companies.

Despite the fact that geographically India is not directly neighbouring Uzbekistan, Tashkent has also developed a strategic partnership with New Delhi. In recent years, the number of joint ventures between the two countries has also increased about five-fold. They are also successfully implementing investment projects in the IT sector, health, pharmaceuticals, agriculture and tourism.

For Uzbekistan, with its open economy, building cooperation with the BRICS countries is quite an important task. This is also important because Uzbekistan's transformation and modernisation path coincides to a large extent with the strategy of the international scientific and technological partnership that it intends to pursue in the framework of BRICS.

Kazakhstan keeps the door open to BRICS membership

Although Kazakhstan has stated that it will not join BRICS for the time being, it keeps the possibility of future membership open. The Kazakh foreign ministry recently confirmed that the country will not apply for BRICS membership for the time being, reflecting the bloc's decision to pause the admission of new members.

Although Kazakhstan has stated that it has no current plans to join the platform, some analysts believe that future membership could be a possibility. In relation to Astana's membership in BRICS, Central Asian media also highlighted that Kazakhstan's entry into BRICS in the next two to three years seems likely for a number of reasons. First, BRICS membership would strengthen Kazakhstan's status as a middle power, increasing its international influence. Second, as sanctions are increasingly imposed on key Kazakh trading partners such as Russia, China and Iran, Kazakhstan is closely examining the proposed alternative payment systems within BRICS (Brics Pay), which could potentially bring economic benefits to Astana.

The Kazakh issue and perspective

Apart from Kazakhstan, not a single Central Asian country has been invited to join BRICS, which could be a positive or negative development. The Kazakh side's position on BRICS membership is complex and justified not only by Astana's own interests but also by its obligations to its Central Asian partners. Perhaps the most convincing argument in this regard is that the C5+1 mechanism is a very effective way of asserting interests between the region and actors outside the region. Therefore, it would not necessarily be expedient for Astana to break this mechanism or create the conditions for mistrust by its neighbours.

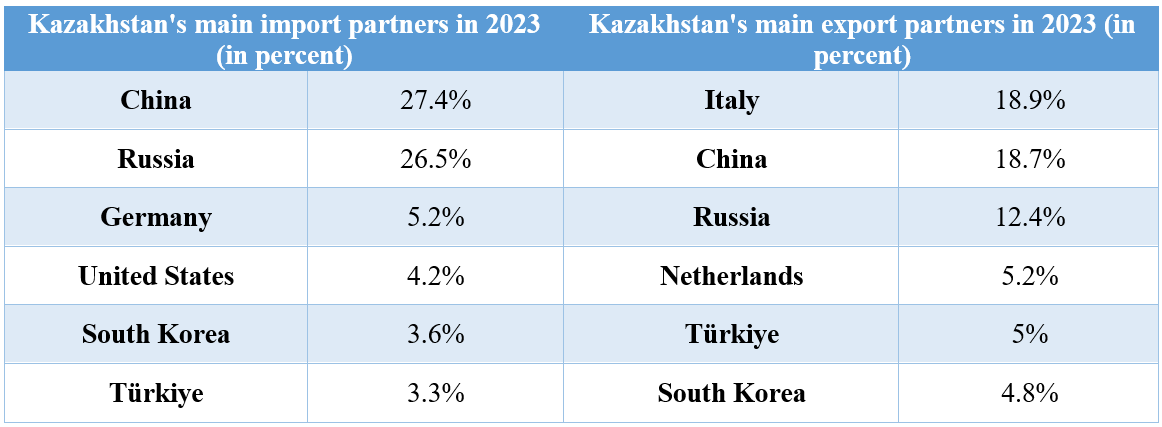

At the same time, the rejection or "pause" of the idea of joining BRICS does not necessarily have a negative impact on Kazakhstan's relations with Russia and China. Indeed, Kazakhstan cooperates with China and Russia in the framework of the SCO (Shanghai Cooperation Organisation) and the EAEU (Eurasian Economic Union) and, like Uzbekistan, has signed several partnership and alliance agreements with Beijing and Moscow. Thus, the informational misrepresentation that Kazakhstan will tomorrow leave Russia's sphere of interest and join the West, which is a phrase and position used in some Russian media, is not necessarily based on reality.

At the same time, however, it should be noted that most Central Asian countries are trying to maintain a certain distance from Russia and only cooperate with Moscow along certain economic lines. For example, in Kyrgyzstan (often referred to as a state with maximum dependence on Moscow for many key issues), banking cooperation with Russian banks has been discontinued. The Kazakh stock exchange recently announced that it would cease cooperation with the sanctioned Moscow stock exchange. In addition, the Russian Federal Veterinary and Phytosanitary Service (in Russian: Rosselkhoznadzor) has suspended the exchange of Belarusian banks with the Kazakh currency exchange: Federal Service for Veterinary and Phytosanitary Surveillance (Russian: Федеральная служба по ветеринаному и фитосанитаному надзоному), the ban on imports of a wide range of agricultural products from Kazakhstan, if not a response to the refusal to join BRICS, may indicate that economic relations between Astana and Moscow are not necessarily smooth (it is also worth noting that Kazakhstan has also imposed a ban on Russian wheat).

Moreover, Kazakhstan's opposition to joining BRICS has been voiced not only within Kazakhstan, but also by Russian experts. Russian analysts opposed to the Kremlin believe that BRICS lacks a structure and a club where one can come, whip the West, make bilateral agreements and forget everything until the next summit, which today does not represent any progress for Kazakhstan.

At the same time, Kazakhstan's decision not to join the BRICS should also be seen from another perspective, the Kazakh perspective. Indeed, Astana believes that if Kazakhstan were to join the BRICS, its EU and US partners would have good reason to express doubts about Kazakhstan's long-held position on so-called multisectoral foreign policy, multilateralism and rhetoric on the role of middle powers. In addition, if Kazakhstan, an emerging middle power, were to join BRICS, it would increase the weight of the organisation, but at the same time it would reposition Kazakhstan further away from the West, something of which Astana is aware.

In addition, it is also noticeable that Russia's anti-Western stance in the Central Asian region has not clearly influenced in a positive direction the perception of BRICS, where it is largely seen as a bloc opposed to the "Global West", which, having lost much during the Cold War and after the collapse of the Soviet Union, would not necessarily be a happy situation for the Central Asian countries to repeat.

At the same time, it should be pointed out that Kazakhstan's current relations with the UN, the Collective Security Treaty Organisation, the Eurasian Economic Union, the Organisation of Turkic States or the Shanghai Cooperation Organisation run in parallel, so the Kazakh position on BRICS membership sounded understandably strange to the Russian side.

In the aftermath of the BRICS summit in Kazan, the picture is also becoming increasingly clear in relation to Kazakhstan and Uzbekistan that the foreign policy objective of both countries remains to balance the interests of the great powers as far as possible without joining new blocs and alliances. However, despite this role of balance, Kazakhstan faces a tough geopolitical challenge in the near future when it chooses a partner to build the country's first nuclear power plant.

The author is a researcher at the Eurasia Center