Transatlantic trade has been paramount for the European continent following the end of WWII. US companies invested heavily in the rebuilding of Western Europe: American exports kickstarted development, and the US maintained a trade surplus vis-à-vis the continent until the late 1960s. Since then, positions have shifted: Western European countries, and later the EU has seen a positive trade balance, mostly driven by increase in domestic competitiveness and US policy factors. Considering the shifting policy regime of Washington, could the EU also rebalance its relationship with China? Could this new co-operation mitigate the potential loss of its US market?

In 2024, the US was the largest trading partner of the EU: bilateral trade was €867 billion, out of which Europe exported €532 billion, with a net surplus of €197 billion. China was the second most important trading partner, accounting for €732 billion worth of trade. The Asian economy is the largest exporter to the EU (€519 billion), resulting in a net deficit of €306 billion. When looking at the structure of the trade, we see that the EU exports to the US mostly consist of pharmaceutical products, road vehicles and machinery, while the US exports petroleum & petroleum products, pharmaceutical products, power generating machinery and natural gas. This is critical, as the US-China trade is fundamentally different: China exports mostly electrical appliances, broadcasting equipment and electric batteries, while the US sells agricultural products (soybeans), petroleum products and semiconductors. This already shows that EU exports cannot easily substitute imports from the US for China, while China itself also remain reliant on US inputs for key industries.

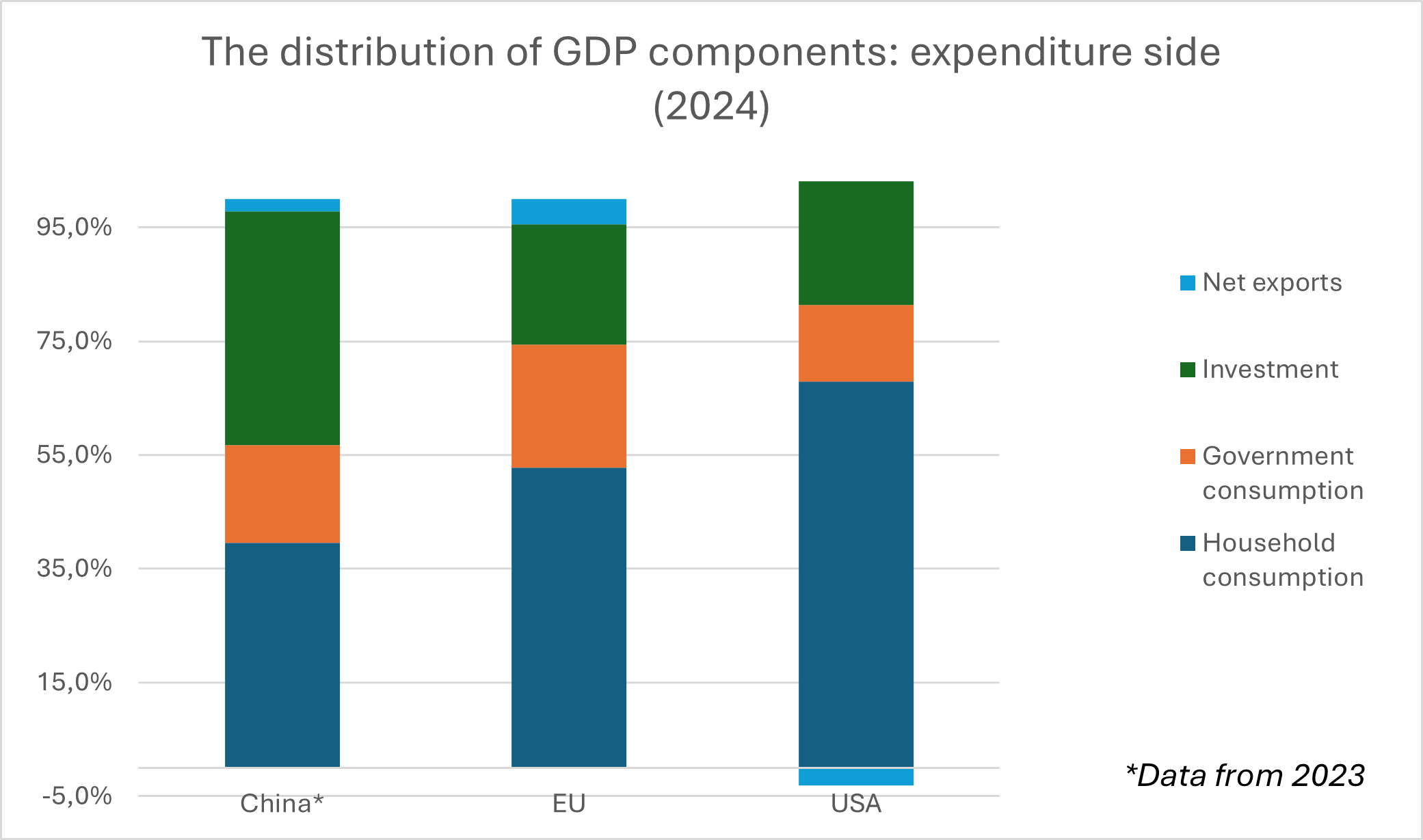

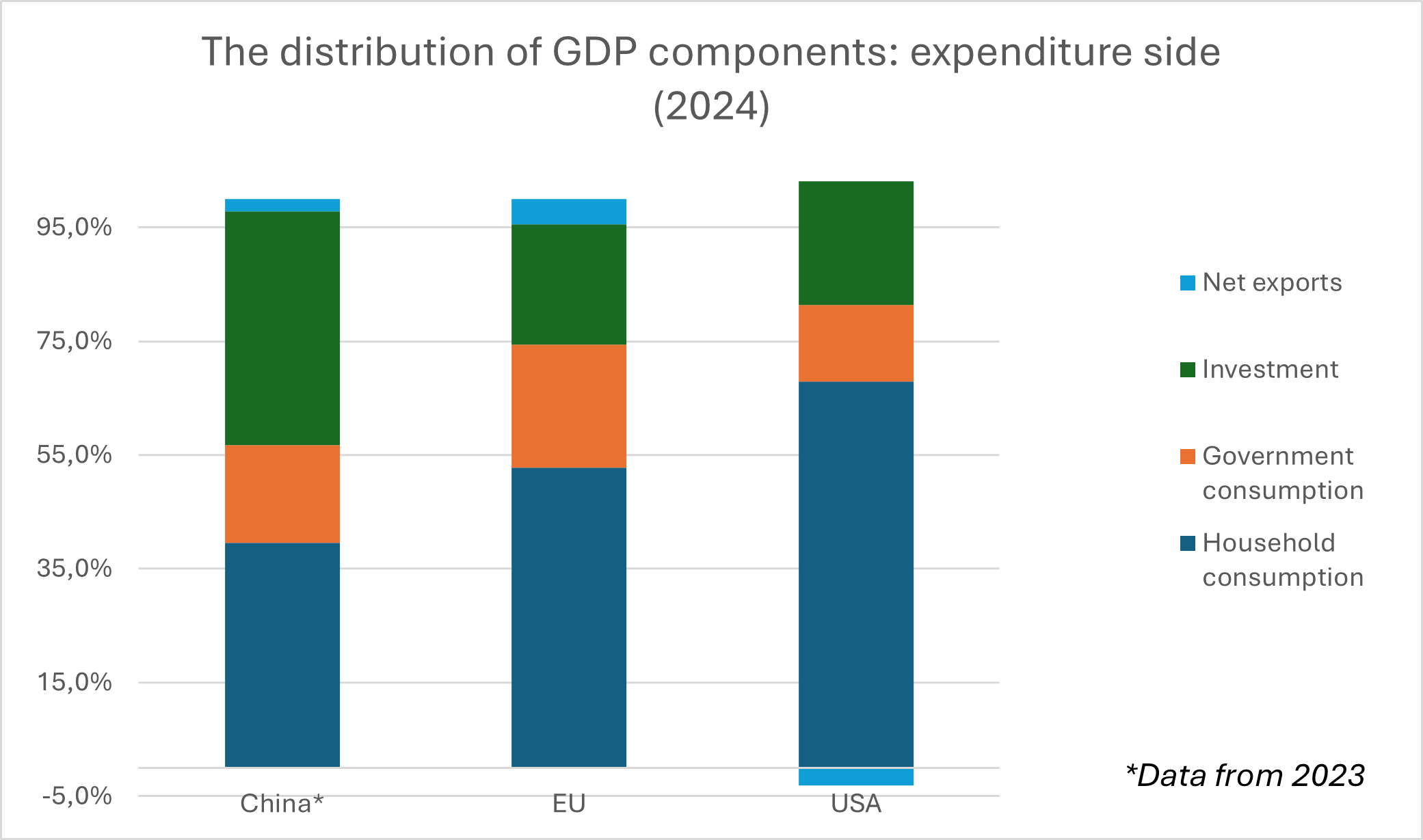

More importantly, if we look at the composition of the three economies, a structural difference is also visible, depicted in the figure below. When it comes to gross domestic product, the US and the EU has a similar structure, where consumption dominates (US over 80%, for the EU around 75%), with similar levels of investment-to-GDP ratios, approx. 22%. However, the Chinese consumption-to-GDP ratio is right around 55%, much lower than in the two, more developed economic regions, with a heavy share of investment (over 40%). From the European standpoint this also suggests that with the current economic structure, European producers of consumption goods would find it hard to sell in China, as domestic final consumption expenditure is relatively low.

Now this could change, as there are signs that China is currently revising its previous export-manufacturing-led model and focus on a new growth model characterised by the “Dual Circulation Strategy”. This transformation would foster economic growth by refocusing the manufacturing sector to produce for domestic consumption, increase the share of services and naturally grow imports while maintaining strategic independence.

A potential result of this strategy could be an increase of import demand, which in turn would lead to more opportunities for EU (and US) corporations.

Nevertheless, based on current trade patterns and economic structures, the EU should maintain fair and mutually beneficial partnerships with both the US and China by promoting connectivity-based trade and FDI approaches to secure stability of input and export markets.

The author is Research Lead at the Institute of Economic Processes at Századvég Foundation