What’s more, not only did it happen in the blink of an eye, but the demand also accelerated: the aerospace parts manufacturing market size is forecasted to increase by USD 210.2 billion, at a CAGR of 4.4% between 2024 and 2029. The market is experiencing significant growth due to the increasing demand for new commercial and defense aircraft. The Asia-Pacific region is the fastest-growing aircraft market due to the rising demand for air travel.

The critical parts components almost exclusively rely on North America and Europe, with major players in the industry originating from these regions, such as Boeing, Airbus, Honeywell, and Raytheon. The U.S. has imposed strict controls on aerospace-related exports to China, particularly affecting high-tech components that are critical to both commercial and military aircraft production.

As a result, China has created COMAC's C919 narrow-body aircraft, which will challenge Boeing and Airbus. While Chinese aircraft still heavily rely on imported components, such as CFM International engines, Honeywell avionics, and landing gear systems, China is striving to replace these imports with domestically produced alternatives. However, progress has been slow due to technical complexity.

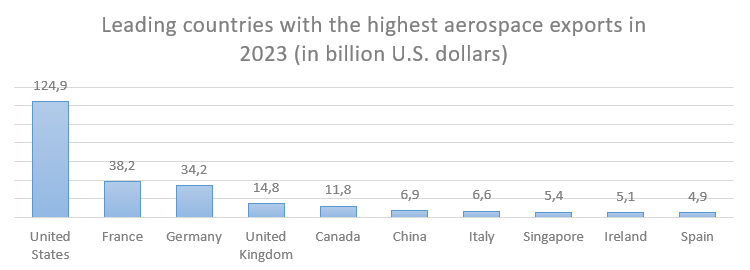

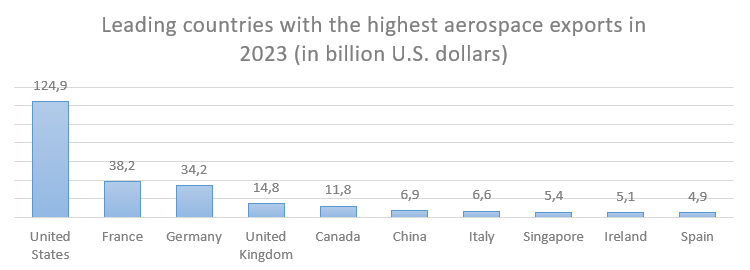

A recent report shows that the United States continues to lead the global aerospace industry by a significant margin. At the same time, China and Singapore are also emerging as increasingly important players, ranking 6th and 8th among the world's top ten exporters.

An average passenger plane consists of between 500,000 and 1.2 million parts. A plane's downtime due to a technical difficulty costs an airline $150,000 per hour, so it is crucial to replace defective parts quickly. We can agree that infrastructure is everything.

The technological conflict between the United States and China has had ripple effects across global aircraft supply chains and has reshaped global logistics.

The result is supply chain disruption, rising costs, and the global repositioning of suppliers. Manufacturing is shifting to friendly nations ("friendshoring") such as India, Vietnam, Mexico, and Eastern European countries, which are becoming alternative manufacturing centers for aircraft components.

India is a major beneficiary of the supply chain realignment, serving as a bridge between the United States and China. Boeing, Airbus, and Lockheed Martin are building partnerships with local manufacturers. India’s aerospace sector is growing, supported by government-backed initiatives such as “Make in India” and the Defence Production and Export Promotion Policy (DPEPP), which aim to boost exports of aircraft components. In addition, the Indian government is offering tax breaks, subsidies, and simplified regulations to foreign aerospace investors. However, skilled labor and compliance with global aviation standards remain challenges for the new supply chain hub.

In this context, India and other emerging markets may find opportunities to fill the gaps left by geopolitical tensions, but the long-term outcome remains uncertain.

The author is the deputy head of the commercial department at a Dubai-based conglomerate.