“It is a large G20 economy and one with very large growth potential,” said economist Omar Al Ubaydli of Bahrain-based thinktank DERASAT. As the region’s top oil producer with substantial reserves of other natural resources, the Kingdom also provides important energy resources security for BRICS+ nations.

For Saudi Arabia, joining the grouping means “geo-strategic diversification,” said Al Ubaydli.

“US economic sanctions have become quite capricious of late, and so being part of an economic bloc that is insulated from such sanctions will grant the Saudi economy direct access to the affected economies,” he added. As a result, this strengthens its diplomatic portfolio, and places it in a “stronger bargaining position” when striking deals outside of BRICS.

Geopolitically, however, Saudi membership is equally as consequential, in what Abishur Prakash, Founder of The Geopolitical Business, Inc. consultancy calls a “massive step” for the bloc.

Beyond oil, Saudi Arabia offers the grouping some unique advantages.

“Saudi Arabia can ‘integrate’ BRICS+ into the Middle East in a way few other nations can,” said Prakash. As a leader in the Middle East and Africa, the kingdom “can open doors” for BRICS+ projects on the continents.

Beyond individual nations, the larger implications of the expansion are noted by the experts. Prakash observes BRICS+ is gaining a major platform on the global stage to begin shaping the world. However, he cautions there are domestic economic obstacles and geopolitical divergences some members face that could challenge the bloc’s effectiveness if not addressed.

“While there is a lot of excitement and expectations for BRICS, the group has serious obstacles it needs to overcome before it can become a powerful geopolitical bloc,” said Parakash. The biggest issue is the growing divergence between India and China viewing each other with “hostile eyes.”

In addition, many BRICS members are already grappling with economic crises. Russia is dealing with sanctions, China with a real estate crisis, Egypt with inflation, and Ethiopia with a sovereign debt default.

And on the geopolitical front, BRICS members are not aligned. “There appears to be no real unity in BRICS around some of the most pivotal issues facing the world today.”

As the US-China trade and technology rivalry continues to disrupt global supply chains, the multilateral trading system embodied by the World Trade Organisation is being restructured into what experts call “minilateralism,” a proliferation of smaller, regional trade agreements that better represent the evolving distribution of economic might among countries. Within these new cross-border arrangements, the use of alternative currencies separate from the US dollar is emerging as a viable option, even a necessity.

Japan’s Liberal Democratic Party (LDP) won a historic victory in the snap lower house election held on 8 February, securing more than a two-thirds majority of seats on its own.

Chinese President Xi Jinping said on Wednesday that he hopes to work with U.S. President Donald Trump in the new year to steer the giant ship of China-U.S. relations steadily forward through wind and storms, and accomplish more big things and good things.

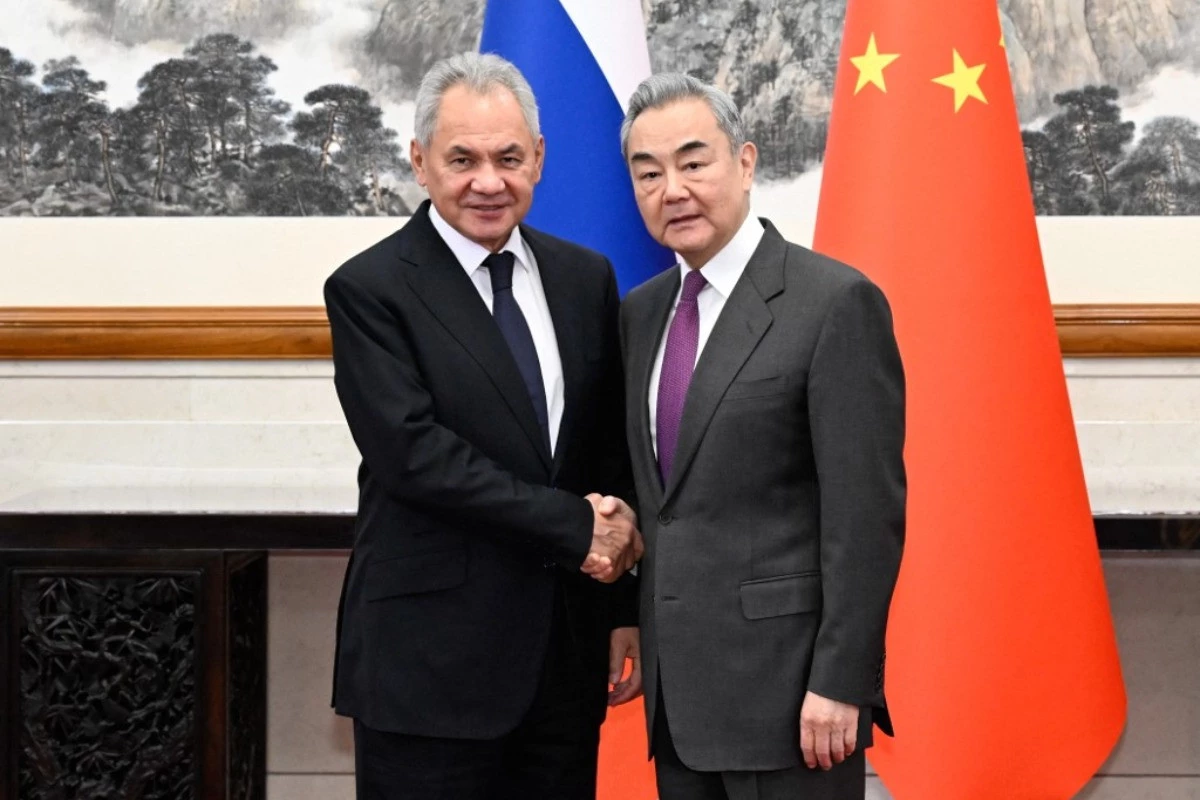

China's top diplomat Wang Yi met with Sergei Shoigu, secretary of the Russian Federation Security Council, in Beijing on Sunday.