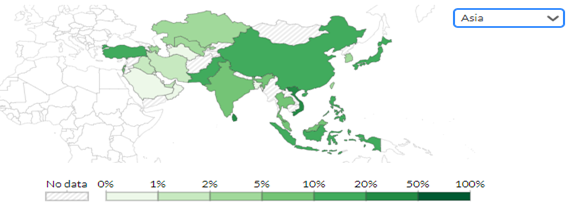

Let’s leave Europe for a moment and turn our attention to Asia, which is not only the largest continent in size, but also home to 60 per cent of the world's population and, according to the World Bank’s 2019 data, 48% of global greenhouse gas emissions. (China alone accounts for 27% of global emissions!) What makes the situation a bit murkier is the fact that the European Union has outsourced many of its high‑output industries to the Far East, where labour is much cheaper. As a result, some of the emissions that are actually generated by European companies actually happens in Asia. It makes sense that the outsourced highly and moderately energy-intensive industries, and the 4.7 billion people living in them (Worldometers 2020 data), are thirsty for massive amounts of energy. Let's see how much of this consumption is covered by renewable energy on the two continents.

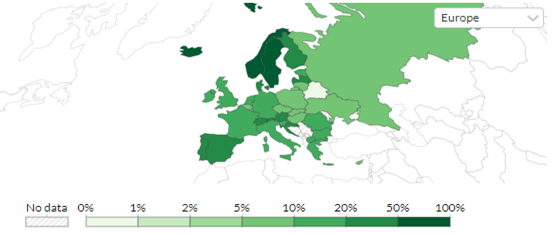

It may seem surprising that, despite the EU's ambitious green package, the share of renewable energy in Europe has actually fallen slightly, while total primary energy consumption – including oil, gas, coal and nuclear – has increased in all countries to 2021.

Although in 2019 Abu Dhabi boasted the cheapest renewable electricity in the world, the energy mix in the Middle East is still primarily based on oil and gas. Total primary energy consumption also increased here (+3.4%), but remained below the European growth rate (4.4%). The Asian continent's use of renewable energy rose to 12.5%, but this is still below the European figure (20%). Meanwhile, Asia's total primary energy consumption also increased by 6 per cent, meaning they were able to satisfy their growth in energy demand by renewable energy.

Of course, if we take into account factors like the population or total final energy consumption of the regions, we can further elaborate the picture of how much our individual energy consumption has improved or worsened from an environmental perspective.

Although Europe is currently ahead in terms of total and per capita renewable energy consumption, the difference in speed between the two continents is reflected in the dynamics of renewable electricity capacity deployment. Europe has in fact doubled its capacity in 11 years, while in the meantime Asia has almost quadrupled it, reaching one and a half million MW of renewable electricity capacity. (For reference, the renewable electricity capacity built in Hungary to date is around 3,000 MW.)

China has long been providing a blueprint regarding renewable energy, but even the countries immediately behind it (India, Indonesia, Japan) have not been able to match its pace.Shortly after the release of the European target figures China made an ambitious commitment in October 2020: They aim to be carbon neutral by 2060, while at COP26 in November 2021, India also announced plans to achieve carbon neutrality before 2070. Net zero emission targets have also been set by Japan, South Korea and six countries in South-East Asia. And the Sustainable Development Scenario (to keep global temperature rise below 2 degrees Celsius under the Paris Agreement) outlines the key actions needed to achieve the target. The countries' carbon neutrality targets are also an additional driver for the construction of renewable energy power plants, as renewable energy is the main element of carbon neutrality measures.

By the end of 2021, 38% of globally installed capacity was already provided by renewable sources, an increase of 9.1% compared to the previous year, with solar power accounting for half of the growth. The growth in renewable capacity in Asia was 12%, with 70% of Asian capacity in China, 10% in India and 8% in Japan. India is forecast to be the third fastest growing market in the world in the coming years. Europe has increased its capacity by only 6.5%, accounting for 21% of total global renewable capacity, while Asia provides almost half of the global capacity – with China alone accounting for a third (source: International Renewable Energy Agency: Renewable Energy Statistics 2022).

For South-East Asia the Sustainable Development Scenario (SDS) projects that renewable capacity will triple by 2030 compared to recent years, and a quarter of cars sold will be electric by 2030. In 2020, 34% of the electricity generation capacity already came from renewable sources, due to the rapid growth of solar power (the renewable capacity increasing by 76% between 2015 and 2021). Half of the countries in the region have signed the global declaration on switching from coal to clean energy, which also gives a strong boost to renewable energy.

Electricity production could increase up to fivefold by 2050, with the demand for electricity also growing, as – for example – there is currently no 100% access to electricity in the region. As a result, by 2050, up to 100% of electricity supply will have to come from renewable sources (up from 26% in 2019). The average annual energy investment in the region between 2016 and 2020 was $70 billion, 40 per cent of which went to clean technologies, mainly solar and wind investments and essential grid upgrades. Under the Sustainable Development Scenario, annual investment will increase to $190 billion by 2030. This region will be a major driver for the global growth in energy demand over the next three decades.China is fundamentally reluctant to make international commitments, so presumably they are confident that the long-standing downward trend in the cost of renewable energy production and investment in energy efficiency will be sufficient to realise both economic development and carbon neutrality. The country is a clear leader in green electricity, with around 70% of the world's solar modules and lithium‑ion batteries and 45% of wind turbines produced there. They are also first in solar panel production followed by Malaysia and Vietnam.

A third of the world's renewable capacity is in China, the cost of the technology is steadily falling (for example, between 2010 and 2020, the cost of solar projects fell by 84%) and it has significant financial resources as well as cheap labour. All this together make the country a world leader in renewable energy. Their rapid development was made possible by the Renewable Energy Act introduced in 2006. As a result of this legislation, by 2021 45% of the country's total energy production capacity came from renewable sources, with the support of government subsidies available until 2020–2021.

The role of solar and wind power in China's energy system has been growing, and in many cases it has been the world leader in recent years. This trend will only accelerate in the future, and by 2050, 90% of China's electricity capacity and production could be renewable, mainly solar and wind. No increase in energy costs is expected in the country, since in 2020, over 75% of solar and wind power plants were able to offer cheaper energy in tenders than the cheapest new fossil‑based plants.

The country has also realised the potential in other renewable energy sources, and is now a world leader in offshore wind farms, which have also helped reduce transmission costs. The potential challenges include the phasing out of coal as their main source of energy and fossil fuel subsidies. They are also expected to become world leaders in energy storage capacity and smart energy management systems, as it is in their best interest to ensure the secure and flexible operation of their vast energy systems (source: International Renewable Energy Agency: China’s route to carbon neutrality).

The race between Europe and Asia is far from over, but Asia (and East Asia in particular) has the advantage, based on the momentum of efforts in recent years.Laura Jókuthy: The author is a senior analyst at Magyar Nemzeti Bank

Balázs Sárvári: The author is a senior researcher at Magyar Nemzeti Bank

This article was originally published in our Hungarian-language magazine Eurázsia in 2022.