Cyclical theories are classical models for explaining economic crises; their common feature is that they separate growth (expansion) and contraction phases in economic development and speak of a dynamic equilibrium with fluctuations instead of a static market equilibrium. It can be assumed that there are long waves in the capitalist economy, lasting an average of 50 years.

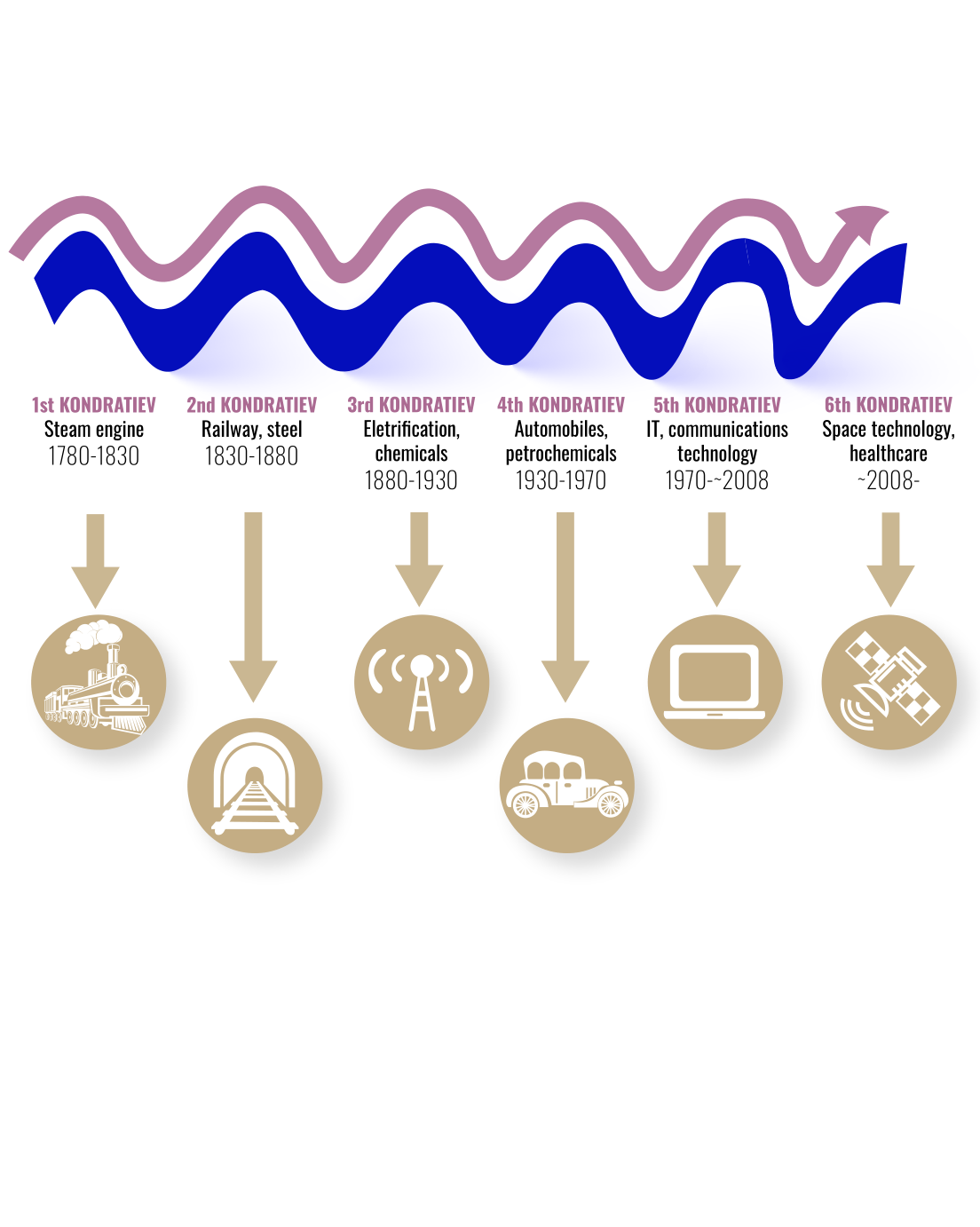

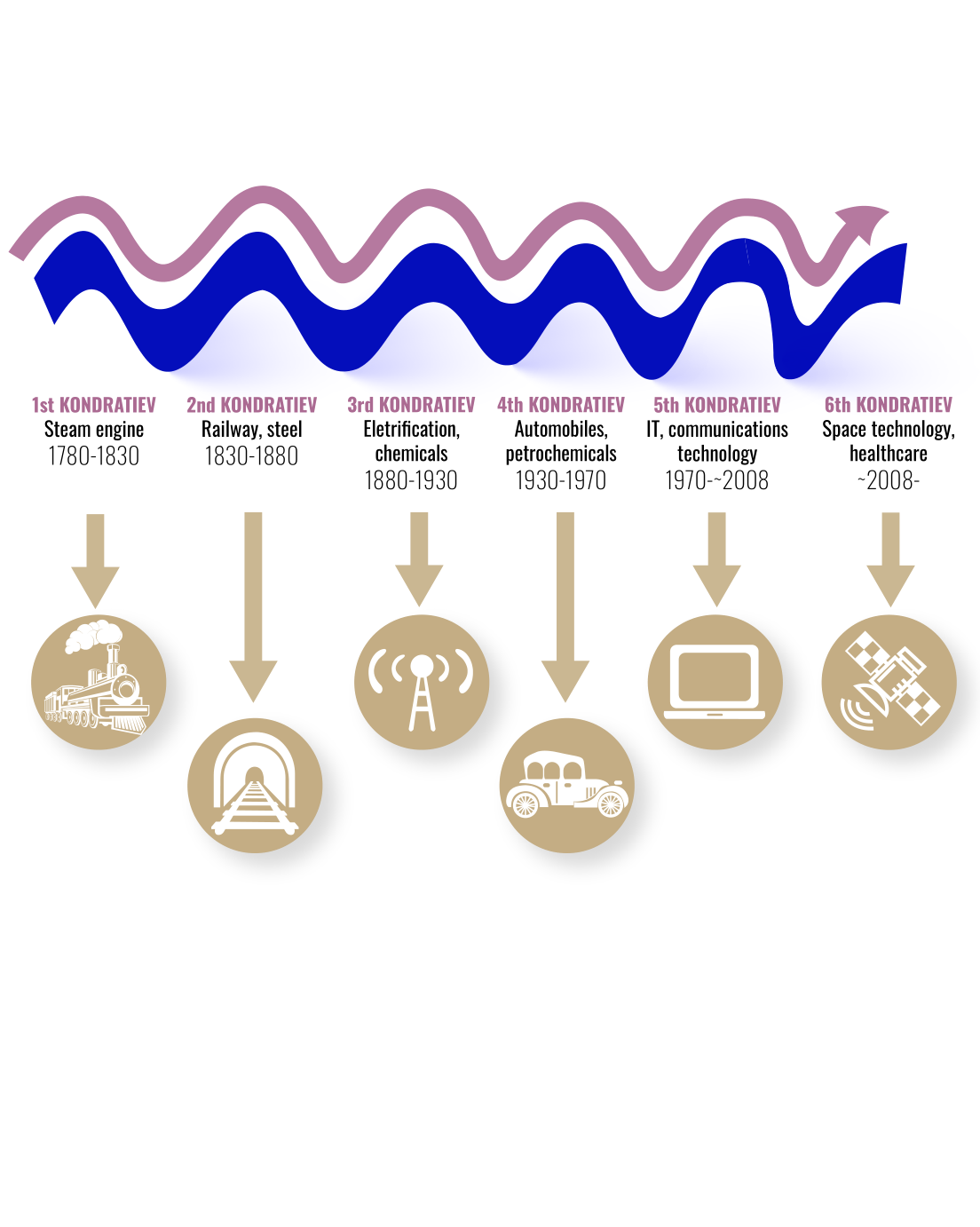

The Kondratiev wave theory explains the long-term boom-bust cycles that exist in capitalist economies around the world. This long-term cycle often lasts between 40 and 60 years and includes periods of high and slow growth in an economy. The Kondratiev wave was developed in the 18th century, and since then economists have identified five Kondratiev waves. The fifth cycle began in the 1970s and was triggered by the advent of computer-based information technology. Industrial society began the transition to an information society, which transformed the world into a global one. In this cycle, the information technology sector became the main engine of economic growth. Many economists believe that we are already in the sixth Kondratiev wave, which began around 2008. In particular, they believe that this cycle will be fuelled by the space age and the development of healthcare. Kondratiev waves have occurred in various industries such as steel, chemicals, technology and others.

Kondratiev noted four empirical regularities, which are as follows:

The author is a researcher at the Eurasia Center of John von Neumann University

George Friedman eloquently argues for three 50-year cycles (40 + 10 years) in the global economy of the last 150 years (Geopolitical Futures, 24 September 2021). The three cases are the United States between 1890 and 1930, Japan between 1950 and 1990 and China between 1980 and 2020. His point is simple and convincing. Based on cheap labour and productive innovation, all three nations manufactured low-cost products for the consumption of wealthy nations. After a 40-year period, rich customers were either unable or unwilling to buy those products and an approximately 10-year period of restructuring followed the 40-year success story. Friedman, however, can’t figure out the reason for his 40 + 10-year cycle. What if the real reason is that the cycle is longer and covers a 60-year period of time? Indeed, three 20-year mini-cycles add up to a 60-year period, because restructuring takes two decades rather than one. We entered Kondratiev’s world of 60-year business cycles based on the investment patterns of the domestic economy. These inner cycles tend to expand into the world economy in the case of our three large nations finally forming a global pattern.

(György Matolcsy – On the Edge of Times: The Rerun of the 1940s and the 1970s, 2022)