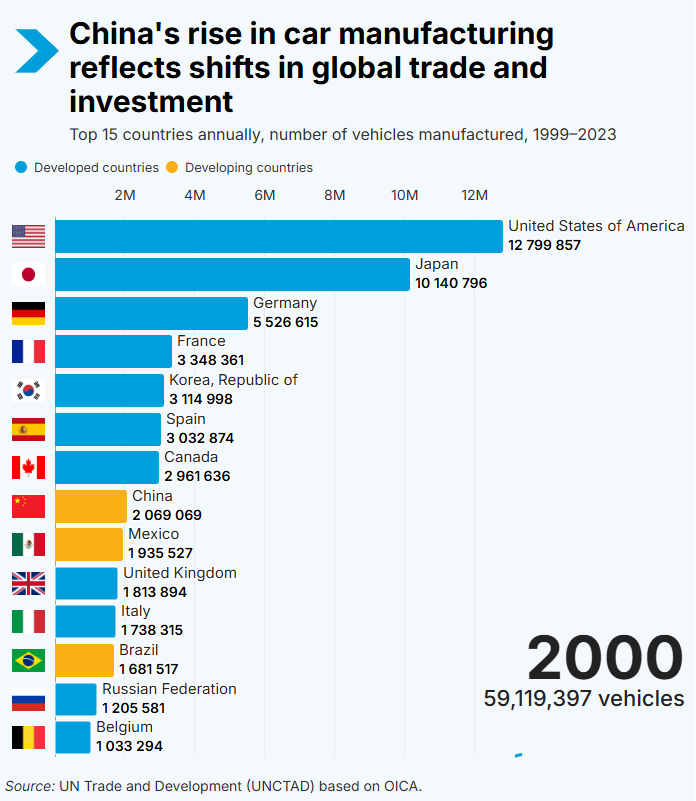

Low manufacturing costs (due to state subsidies, vertical integration, and cheap labor) enable Chinese electric vehicles to undercut Western brands by 30-40% in global markets.

And why has the Middle East become one of China's key EV partners? The reason lies in U.S. tariffs and restrictions on Chinese EVs and batteries, which have pushed China to focus on Asia, the Middle East, and Africa. The Belt and Road Initiative, affordable mid-range products, and aggressive dealership expansion allow China to penetrate these regions, primarily through brands such as BYD, NIO, Geely, and MG (owned by SAIC Motor).

The United Arab Emirates ranks 7th globally, and 1st in the MENA region, in electric mobility readiness, thanks to its robust charging infrastructure. Between 2017 and 2022, the number of battery charging stations in the UAE increased by 717%, reaching 253 stations, and projections suggest this number will soar to 2,267 by 2027.

NIO and XPeng are promoting battery-swapping technology to facilitate EV adoption in hot climates, where fast charging can affect battery performance. "A 3-minute swap for a fully charged battery without getting off the car," claims NIO on its website.

While one might assume that the Middle East—traditionally associated with oil—has little interest in promoting electric vehicles, the reality is different. Oil is a finite resource, and Dubai, which by now gains most of its income through international trade and tourism, has a forward-thinking approach. Government initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 encourage EV adoption in the region, benefiting Chinese exports.

China’s dominance in lithium, cobalt, and nickel processing poses a supply chain risk for the Middle East’s growing EV market. While Gulf nations are investing in EV infrastructure and local production, they remain reliant on Chinese battery technology. Geopolitical tensions and potential export restrictions from China could disrupt supply chains, impacting EV adoption and pricing in the region. To mitigate risks, Middle Eastern countries are diversifying trade partnerships, investing in battery recycling, and exploring local mineral sourcing while leveraging China’s expertise through strategic alliances and Belt and Road investments.

The author is the deputy head of the commercial department at a Dubai-based conglomerate